Storing cryptocurrency between poker sessions requires balancing accessibility with security. Unlike traditional bankroll management where funds sit in bank accounts or site balances, crypto storage demands active custody decisions. The choice between hot wallets (online, immediate access) and cold storage (offline, maximum security) directly affects both operational convenience and risk exposure.

Most players default to leaving funds on-site or in exchange wallets—custodial solutions where third parties control private keys. This creates platform risk: exchange hacks, insolvency, or regulatory seizure can eliminate access to your bankroll instantly. Self-custody eliminates counterparty risk but shifts responsibility entirely to you. Lost keys mean permanent loss with no recovery mechanism.

This guide explains custody models at the protocol level, breaks down hot/cold wallet architecture, and provides operational security frameworks professional players use to protect large crypto poker bankrolls across different storage tiers.

Understanding Custody Models

Cryptocurrency custody operates on a fundamental principle: whoever controls the private keys controls the funds. This differs completely from traditional finance where institutions maintain custody and provide account recovery. In crypto, key possession is absolute—there’s no “forgot password” mechanism, no customer service to restore access, no insurance beyond what platforms voluntarily provide.

Custodial storage means a third party (exchange, poker site, payment processor) holds your private keys. You access funds through their interface using username and password. The platform can freeze accounts, process withdrawals, or lose funds to security breaches. Non-custodial storage means you control private keys through wallet software or hardware devices. Only you can authorize transactions, but you’re solely responsible for key security and backup.

The critical insight: custodial and self-custody models have inverse risk profiles. Exchanges expose you to platform risk but eliminate personal operational risk. Self-custody eliminates platform risk but creates personal operational risk. Neither is universally superior—optimal strategy uses both in proportions matching your security knowledge and fund allocation needs.

Hot Wallet vs Cold Storage Architecture

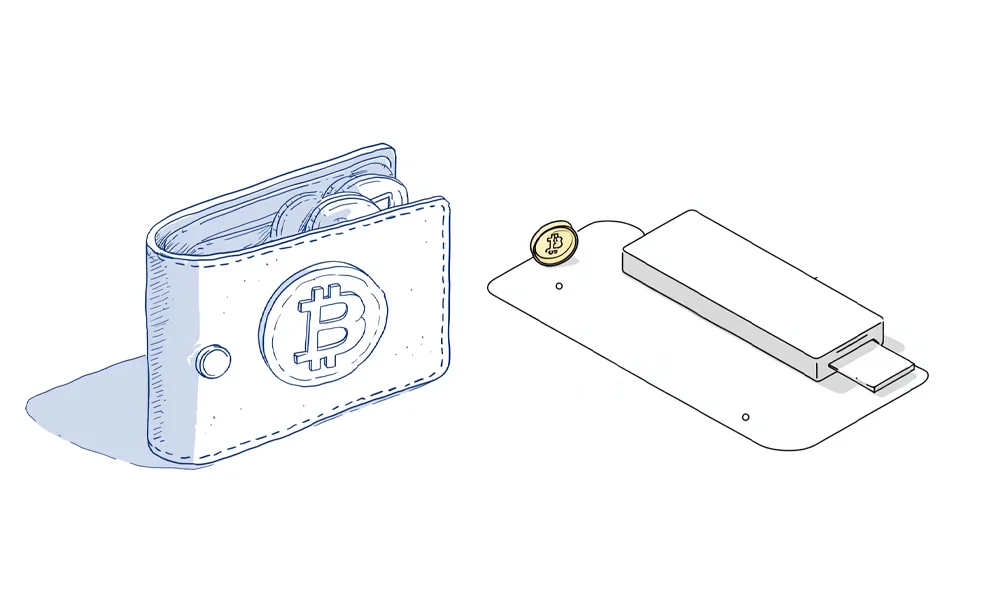

Hot wallets maintain constant internet connectivity, enabling immediate transaction signing. Software wallets on phones or computers, browser extensions, and exchange accounts all qualify as hot storage. Cold storage keeps private keys completely offline—hardware wallets, paper wallets, or air-gapped computers. The connectivity difference creates the security trade-off: hot wallets offer convenience but face remote attack vectors, cold storage maximizes security but requires deliberate access procedures.

Bitcoin and Ethereum hot wallets expose private keys to internet-connected devices. Malware, keyloggers, or phishing attacks can compromise keys and drain funds instantly. This risk is real and frequent—security researchers document thousands of successful hot wallet compromises monthly across cryptocurrency users. Cold storage eliminates remote attack vectors entirely since private keys never touch internet-connected systems.

However, cold storage introduces operational friction. Depositing to a poker site from cold storage requires connecting hardware wallet, confirming transaction on device, waiting for blockchain confirmation—a 5-10 minute process minimum. Hot wallet deposits take 30 seconds. For players who value immediate session access, pure cold storage becomes impractical. This friction explains why professional players use tiered storage rather than single-solution approaches.

Hardware Wallet Security Model

Hardware wallets (Ledger, Trezor, Coldcard) store private keys in secure elements—specialized chips designed to resist extraction even with physical access. When signing transactions, the hardware wallet receives transaction data from your computer, signs internally using isolated private keys, then returns only the signature. Private keys never leave the secure element, even when the device connects via USB.

This architecture protects against compromised computers. Even if your laptop has malware, attackers can’t extract private keys from the hardware wallet’s secure element. However, hardware wallets don’t protect against all threats: physical theft, supply chain attacks (compromised devices before purchase), or user error (sending to wrong addresses, approving malicious transactions) remain vectors. Hardware wallets are security tools, not security guarantees.

What This Means for Poker Bankroll Storage

Applying custody concepts to poker requires matching storage tiers to bankroll segments. Professional players don’t keep entire bankrolls in single locations—they split funds across multiple custody types based on access frequency and security requirements. A typical allocation might be: 10-15% hot wallet (session funds), 25-35% exchange/site balance (active play), 50-60% cold storage (reserve bankroll).

This tiered approach balances competing priorities. Hot wallet funds enable immediate deposits without friction, supporting spontaneous play or last-minute tournament entries. Site balances eliminate deposit delays entirely. Cold storage protects the bulk of bankroll from both platform and operational risks. The specific percentages vary by player—grinders who play daily might keep 40% hot/on-site, recreational players might keep 90% cold with minimal hot funds.

The compounding effect of theft or loss makes tier selection critical. Losing a hot wallet with 10% of bankroll is recoverable—losing cold storage with 80% is career-ending for most players. Risk-adjusted allocation means keeping amounts you can afford to lose completely in hot/custodial storage, with core bankroll in cold storage requiring deliberate multi-step access procedures.

Common Mistakes Players Make

- Keeping entire bankroll in exchange wallets for convenience, exposing full amount to platform risk (exchange hacks, insolvency, regulatory seizure)

- Using hot wallets on malware-infected devices without realizing compromise has occurred, discovering theft only after funds drain

- Writing hardware wallet seed phrases digitally (phone notes, cloud documents) which defeats offline security by creating online attack vectors

- Storing all backups in single location (all copies in one house) where single disaster event (fire, flood, theft) eliminates all recovery options

- Never testing recovery procedures until emergency occurs, discovering backup incompleteness or process errors when funds are at stake

Operational Security Practices

Effective crypto storage requires operational protocols that address both technical and human failure modes. Technical security covers encryption, multi-signature schemes, and secure hardware. Human security covers backup procedures, access controls, and recovery testing. Most crypto losses result from human error rather than technical exploitation—forgotten passwords, lost seed phrases, phishing attacks succeed more often than sophisticated hacks.

Seed phrase management is the critical operational security task. Hardware wallets and most software wallets generate 12-24 word seed phrases that deterministically derive all private keys. Anyone with your seed phrase controls your funds permanently—there’s no expiration, no way to invalidate compromised seeds. Seed phrases must be stored offline (never digital), in multiple locations (protect against physical loss), and secured against unauthorized access (protect against theft).

Professional-grade seed storage uses metal backup plates (fire/water resistant) stored in multiple geographic locations. A common approach: one copy in primary residence safe, one in bank safety deposit box, one with trusted family in different city. This provides redundancy against local disaster while maintaining physical security through geographic distribution. Never store seeds in cloud storage, email, or phone photos—these digital copies create remote attack vectors that defeat hardware wallet security.

Multi-Signature Wallet Architecture

Multi-signature (multi-sig) wallets require multiple private keys to authorize transactions. A 2-of-3 multi-sig needs any two of three keys to spend funds. This creates redundancy (lose one key, still have access) while improving security (thief needs two keys, not one). Professional players with large bankrolls often use multi-sig for cold storage—keys distributed across multiple hardware wallets in different locations.

Multi-sig eliminates single points of failure but increases operational complexity. Setting up multi-sig requires technical knowledge beyond basic wallet usage. Transaction signing becomes multi-step: create transaction with one key, partially sign, transfer to second location, complete signing with second key, broadcast. For maximum security cold storage, this complexity is justified. For hot wallets requiring frequent access, multi-sig becomes impractical.

Weekly Session Preparation

Player maintains 60% of bankroll in hardware wallet cold storage, 30% in hot wallet, 10% on poker site. Planning for weekend tournament series requiring multiple entries and potential rebuys.

- Current allocation: 2.5 BTC total bankroll (at typical market rates: $75,000-$150,000 approximate value depending on current conditions)

- Cold storage: 1.5 BTC (hardware wallet, stored in fireproof safe)

- Hot wallet: 0.75 BTC (software wallet on dedicated crypto laptop)

- Site balance: 0.25 BTC (immediate access for play)

- Tournament budget: 0.5 BTC total exposure for weekend series

The Technical Process

Thursday evening, player reviews tournament schedule and estimates exposure. Determines 0.5 BTC needed (0.25 BTC already on-site, needs 0.25 BTC additional). Retrieves hardware wallet from safe, connects to computer, initiates 0.25 BTC transfer to hot wallet. Hardware wallet displays transaction details on device screen—verifies receiving address matches hot wallet exactly. Confirms transaction on hardware device. Transaction broadcasts to network, confirms within 20-30 minutes. Hot wallet now holds 1.0 BTC total.

Friday afternoon before first tournament, transfers 0.25 BTC from hot wallet to poker site. Software wallet transaction takes 30 seconds to create, confirms in 10-15 minutes. Site balance now 0.5 BTC, sufficient for full weekend exposure. Hardware wallet returns to safe, protecting 1.5 BTC core bankroll. Hot wallet retains 0.75 BTC for contingency or additional deposits if needed.

The Outcome

Player accesses funds when needed without exposing entire bankroll to hot wallet risk. Cold storage remained offline except for single 5-minute access window. If hot wallet compromises during weekend (malware, phishing, device theft), maximum loss is 0.75 BTC (30% of bankroll). Core 1.5 BTC in cold storage remains protected. Post-tournament, player can reverse flow: withdraw from site to hot wallet, consolidate to cold storage during next planned access. This maintains security while supporting operational flexibility.

How Professionals Handle Crypto Storage

Experienced crypto poker players treat storage security as bankroll protection requiring active management. They implement tiered storage with clear allocation rules, maintain geographic backup distribution, use dedicated devices for crypto operations, and conduct quarterly recovery testing to verify backup completeness.

Technical Risk Management

Professional players track custody risk across all storage locations. They calculate platform exposure (exchange + site balances), hot wallet exposure (software wallets), and cold storage allocation. Target allocations shift based on play frequency—active grinders accept higher hot/platform exposure (40-50%) for operational efficiency, recreational players minimize hot exposure (10-20%) since they access funds infrequently.

Advanced players use purpose-specific devices for crypto operations. A dedicated laptop or phone for hot wallet access, never used for email, social media, or web browsing. This reduces malware exposure dramatically since most infections occur through compromised websites or phishing emails. The dedicated device runs minimal software, receives regular security updates, and connects only to cryptocurrency networks and poker sites.

System Optimization

Professionals implement structured access protocols that balance security with operational needs. Cold storage moves happen on predictable schedules (weekly, monthly) rather than ad-hoc. This reduces exposure windows where hardware wallets connect to internet-connected computers. They batch transactions during cold storage access—instead of multiple small withdrawals, they withdraw larger amounts during single access windows.

Professional players also maintain detailed custody documentation (without sensitive data). A spreadsheet tracking allocation percentages, last access dates, backup locations (without revealing specific locations), and recovery procedures. This documentation ensures storage strategy remains consistent over time and provides reference during emergencies when memory and judgment may be compromised.

Technical Evolution in Wallet Security

Current wallet security relies on isolated private key storage—hardware wallets, multi-sig schemes, or air-gapped computers. Emerging approaches use social recovery (trusted contacts hold recovery shards), threshold signatures (key shares distributed across devices requiring cooperation to sign), and hardware security modules (enterprise-grade secure elements integrated in consumer devices).

Social recovery wallets like Argent allow key recovery through guardian approval—trusted contacts who can vote to authorize wallet recovery without ever seeing your private key. This eliminates seed phrase backup requirements while maintaining security against single guardian compromise. However, social recovery requires trust in guardian selection and introduces social engineering vectors. The technology improves convenience but creates new attack surfaces.

The long-term trend points toward security through distributed trust rather than individual responsibility. Multi-party computation, threshold signatures, and social recovery reduce catastrophic failure risk (complete key loss) while maintaining reasonable security against theft. For poker players, these technologies will eventually enable security-by-default rather than security-through-expertise, lowering the technical barrier to proper custody management.

Frequently Asked Questions

Should I keep my poker bankroll on the poker site or in my own wallet?

Neither exclusively. Optimal storage splits funds across tiers: keep immediate session funds on-site for zero-delay access, maintain hot wallet balance for quick deposits (10-30% of bankroll), and protect core bankroll in cold storage (50-70%). Site storage is convenient but exposes funds to platform risk. Full self-custody maximizes security but creates operational friction. Use both strategically based on access frequency needs.

How do hardware wallets protect against computer viruses?

Hardware wallets store private keys in isolated secure elements that never connect directly to the internet or expose keys to your computer. When signing transactions, the wallet receives transaction data, signs internally using isolated keys, then returns only the signature. Even if your computer has malware, it cannot extract private keys from the hardware wallet’s secure element. However, malware can still trick you into approving malicious transactions—always verify transaction details on the hardware wallet screen.

What happens if I lose my hardware wallet?

Losing the physical device doesn’t mean losing funds—if you backed up the seed phrase correctly. Hardware wallets generate 12-24 word seed phrases during initial setup. These words mathematically derive all your private keys. With the seed phrase, you can restore full wallet access on any compatible device. Without the seed phrase, funds are permanently unrecoverable. This makes seed phrase backup more critical than hardware device protection—the device is replaceable, the seed phrase is not.

Should I store my seed phrase in cloud storage for backup?

Never. Cloud storage, email, phone photos, or any digital backup creates remote attack vectors. If cloud accounts compromise, attackers gain permanent access to your funds. Store seed phrases offline only—written on paper or stamped on metal plates, in multiple physical locations. A common approach: one copy in home safe, one in bank safety deposit box, one with trusted family in different city. This provides redundancy against local disaster while maintaining physical security.

Is it safer to keep funds on a regulated exchange or in my own wallet?

Depends on your security competence and amount at stake. Exchanges offer convenience and (sometimes) insurance but expose you to platform risk—hacks, insolvency, regulatory seizure. Self-custody eliminates counterparty risk but requires correct operational security. Many experienced users compromise: keep trading/session amounts on exchanges (tolerable loss if platform fails), maintain long-term holdings in self-custody. For amounts representing significant wealth, self-custody with proper backup procedures generally provides superior security once you understand the operational requirements.

How often should I test my backup recovery process?

Quarterly testing is recommended, annually minimum. Recovery testing means: obtain backup seed phrase, attempt full wallet restoration on clean device, verify all funds appear correctly, then wipe test device. This confirms backup completeness and your ability to execute recovery under stress. Many people discover backup failures only during actual emergencies when mistakes are costly. Regular testing while funds are secure reveals problems you can fix proactively. Document the process and update procedures after each test.