The SEC continues to be called out for questionable suits against the crypto ecosystem

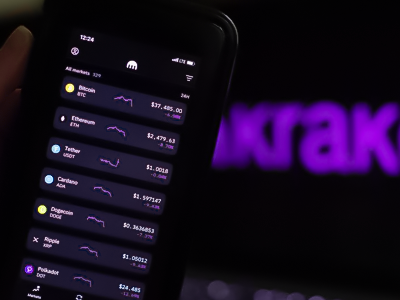

The Kraken cryptocurrency exchange has filed a motion to dismiss a November lawsuit from the US Securities and Exchange Commission (SEC), saying it sets a “dangerous precedent” for the agency’s remit.

Kraken filed the motion with a San Francisco federal court on February 22, accompanied by a corresponding blog post that said, “The SEC’s theory is that there can be an investment contract with no contract, no post-sale obligations, and no interaction at all between the issuer and the purchaser.”

This contention means it “has no limiting principle” and would give the SEC “boundless authority over commerce and potentially open up the floodgates to private securities law claims,” Kraken argued.

The SEC filed its suit against Kraken last year, accusing the firm of unlawfully making millions of dollars in profits from “crypto asset securities” transactions and offering “exchange, broker, dealer, and clearing agency” services without registering with the regulator “as required by law.”

Kraken says the case should be dismissed based on the major questions doctrine, a 2022 ruling by the US Supreme Court stating that Congress seeks to pass legislation rather than give regulators authority. Other major crypto firms, such as Coinbase, Binance and Terraform Labs, have quoted the doctrine in attempting to have SEC lawsuits dismissed.

Congress is discussing how crypto should be regulated, and numerous bills to manage the industry are at various phases of evolution. Kraken testified before a crypto regulation Congressional hearing last May that the current rules are insufficient and a framework to restrict the SEC’s authority and expand the Commodity Futures Trading Commission to oversee exchanges should be implemented.

“The very next day, the SEC called Kraken to say it was going to sue,” said the exchange in its most recent filing. “And this Complaint followed.”